$ENA: The Yield-Bearing Engine of Ethena's Synthetic Dollar

Ethena is a synthetic dollar and yield protocol built around the $ENA token. $ENA captures value from the Ethena ecosystem primarily through yield-bearing staking, complemented by governance rights and structured lock mechanics that align incentives across participants.

This article provides a comprehensive overview of $ENA’s value structure, implementation mechanics, key metrics, comparative positioning, and the protocol’s long-term flywheel.

$ENA Value Structure

$ENA aggregates four distinct origins of value:

-

Cashflow Ethena generates protocol cashflows from ecosystem incentives such as portions of sUSDe APY and allocations from Ethereal token supply.

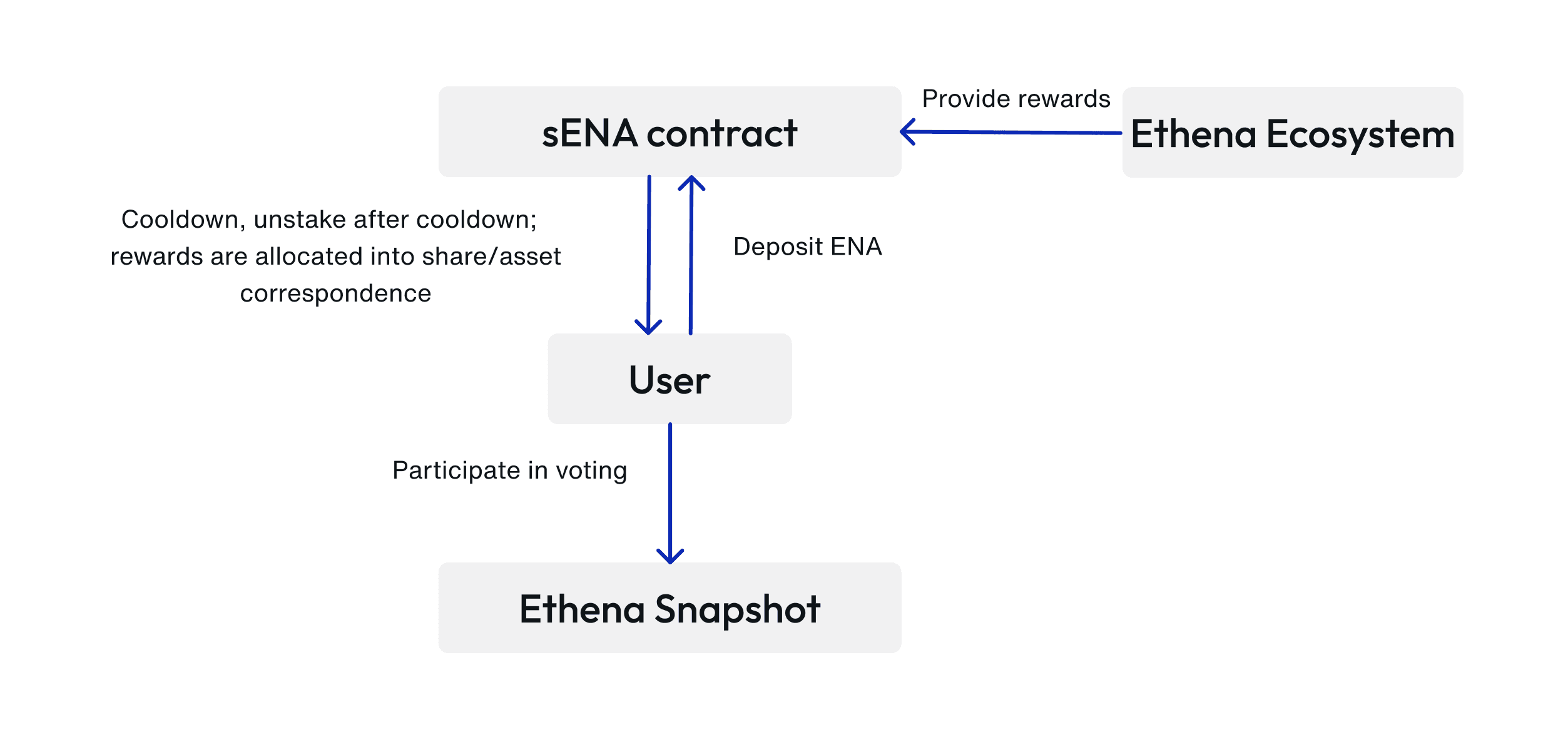

Value-Capturing Mechanism: ENA can be staked into sENA, a liquid representation of locked ENA, which accrues these rewards on a pro rata basis.

For example, Ethereal has committed to allocate ≥15% of its token supply to sENA distributions, which are delivered pro rata to sENA holders.

Rewards distributed to date: 16,937,004 ENA ($4,092,029).

-

Governance ENA is a governance token: holding ENA confers immediate voting rights (governance conducted via Snapshot).

Governance scope: Risk Committee composition, acceptable backing assets for USDe, allocation of Reserve Funds, launches of ecosystem components (e.g., Ethereal DEX), and other protocol-level policy.

Governance power is exercised both via committee (rotating Risk Committee) and ENA holder votes.

-

Conditional Action Participation in governance is actioned through a structured pipeline: forum discussion → 7-day deliberation → Snapshot vote → execution if passed.

Conditional actions are binding when approved, meaning governance is operational and consequential rather than purely symbolic.

-

Transferability Restriction (Staking Cooldown) sENA itself is liquid and transferable. However, converting sENA back into ENA requires an unstaking cooldown (currently 7 days) followed by a fixed withdrawal window (for example, 14 days in the current configuration).

This period of illiquidity for the underlying ENA reduces short-term sell pressure and aligns long-term incentives.

Core Mechanisms

Staking & Rewards

sENA is the yield-bearing representation: staking ENA mints sENA which accrues rewards continuously.

Rewards are claimable after unstaking and cooldown requirements are met.

Reward supply is directly linked to protocol activity (USDe adoption, DEX usage, ecosystem incentives).

Governance & Risk Committee

The Risk Committee comprises 6 seats, staggered elections (3 seats every 6 months).

ENA holders with ≥1,000 ENA can nominate; nominees undergo checks (KYC/AML via the foundation) before being placed on committee ballots.

Committee and Snapshot votes implement protocol financial decisions (e.g., providing idle stablecoin liquidity, collateral lists).

Key Metrics (snapshot)

- Total ENA Supply: 15,000,000,000 $ENA

- Circulating Supply: 7,690,625,000 $ENA

- ENA Staked (sENA): 941,481,345 $ENA (6.28% of total supply; 12.24% of circulating supply)

- ENA in Unstaking Cooldown: 75,335,910 $ENA

- Rewards Distributed to Stakers: 16,937,004 $ENA ($4,092,029)

- sENA / ENA Ratio: 1.018

- Annualized sENA APR: 1.62%

Recent Dynamics & Momentum

- sENA rewards have been steady but modest in APR (annualized 1.62%), reflecting conservative distribution pacing aligned with protocol risk management.

- Staking penetration is moderate (6.28% of total supply), suggesting room for deeper yield programs or incentives if the team wishes to accelerate adoption.

- Governance activity is structured and active (committee nomination/election cadence is in place), which increases protocol robustness over time.

Comparative Positioning

- Versus pure governance tokens: $ENA couples governance with real cashflows, holders receive yield rather than only voting power.

- Versus pure yield tokens: $ENA’s yield is tied to protocol economics and governance; staking includes lockup mechanics and committee oversight, which reduces short-term farming behaviour.

- Unlike stablecoin protocols, where the token itself often functions as the stable asset, $ENA serves instead as the governance and yield backbone of Ethena’s synthetic dollar (USDe).

Long-Term Flywheel

- Greater USDe adoption → more protocol activity and revenue.

- Higher revenue → increased allocations to sENA rewards and ecosystem incentives.

- Stronger rewards → more ENA staked into sENA.

- Increased staking → reduced circulating liquidity + stronger long-term alignment of incentives.

- Stronger governance and aligned incentives → safer, more attractive protocol for users and partners → cycle repeats.

$ENA Value Summary

$ENA functions as a hybrid token combining cashflow, governance, conditional action, and semi-liquid staking. Current on-chain metrics show meaningful reward distribution (16,937,004 $ENA / $4,092,029) and a meaningful base of stakers (941,481,345 $ENA). The token’s design aligns stakeholder incentives through a modest yield, binding governance, and a cooling period that stabilizes supply dynamics.

Ethena’s path to scale is clear: drive USDe adoption and ecosystem activity to expand the reward pool, which in turn deepens staking and governance participation, reinforcing $ENA’s economic and cultural role inside the protocol.