1. REPRESENTATION

The USDe mint-and-redeem process requires KYC procedures. A whitelisted user aiming to mint USDe can send a signed EIP712 order to the Ethena minting server. A number of checks are then made, and if Ethena approves, the minting and transfer of the user's backing assets and the newly minted USDe are conducted atomically.

Immediately, the off-chain hedging system takes the necessary measures to achieve delta neutrality of the backing asset and possibly generate yield on the asset. It is worth repeating that Ethena never transfers the backing asset away in its strategy manipulations, only delegates it. Redemption of USDe follows a similar workflow.

Importantly, despite being minted from backing assets, USDe is not a loan stablecoin and is always collateralized at 100%. Its purpose is not to facilitate a borrowing market, but rather to stabilize collateral price fluctuations.

2. YIELD-BEARING STAKING

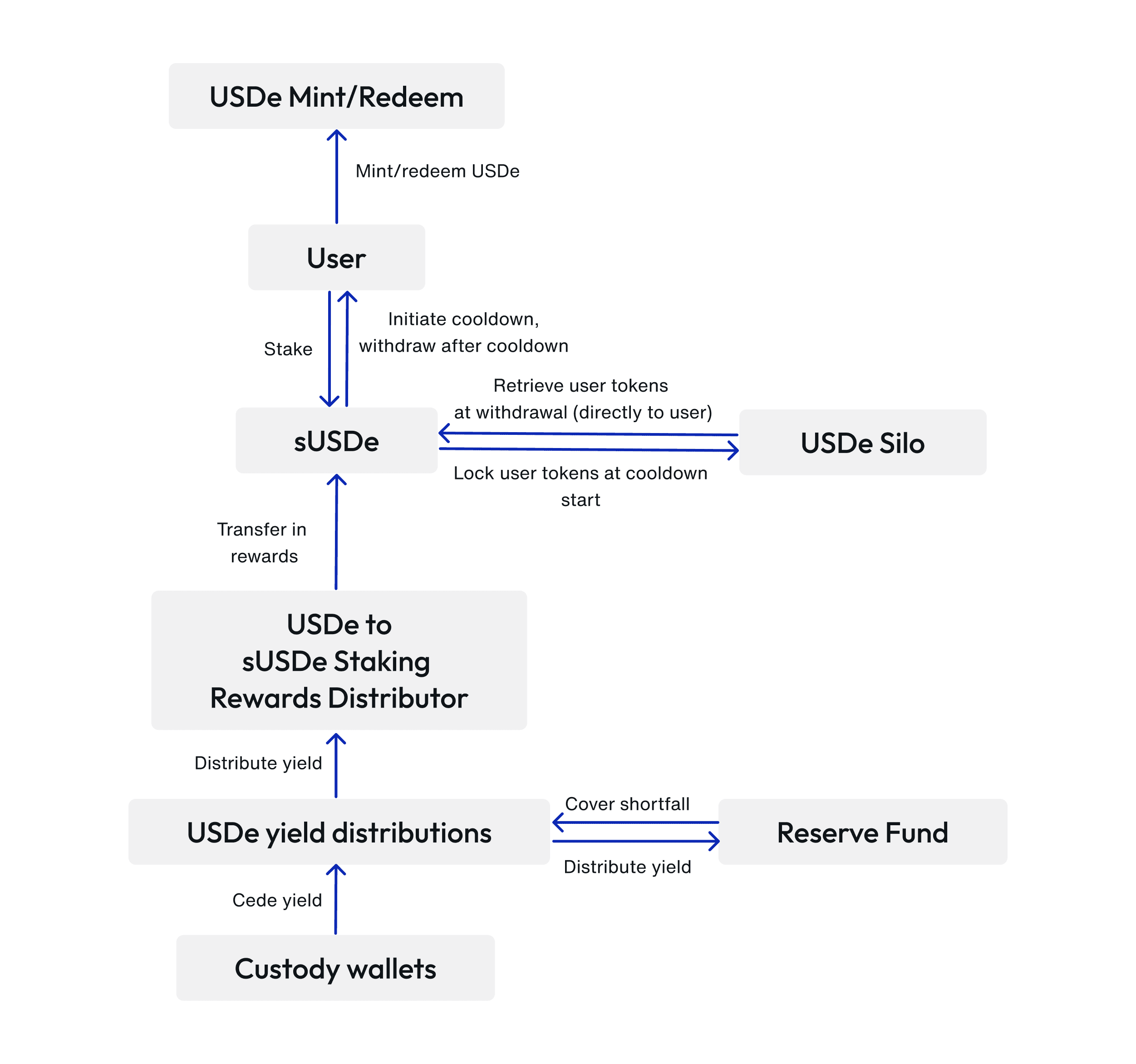

It is possible to stake USDe in the sUSDe contract (a ERC4626 reward pool). As such, the user receives sUSDe, which act as (transferable) shares of the totality of USDe in the sUSDe contract. Thereafter, when profit is made by one of the three pathways (see USDe Value Drivers), it is distributed by a revenue split algorithm, with part of it going towards the Reserve Fund, and part of it going to the sUSDe contract.

The distribution occurs once every 8 hours and is weakly guaranteed to be nonnegative by the presence of the Reserve Fund, whose purpose is in part to secure the sUSDe holders against negative cashflow by balancing it out to zero (negative cashflow is possible without the Reserve Fund because the short perpetuals, which are necessarily created by the protocol in order to achieve delta neutrality, can become greatly unprofitable). The Reserve Fund is a multisig controlled by Ethena and comprised of assets determined by the governance.

When the user needs to unstake sUSDe, he sends a cooldown request and can unstake and withdraw his tokens once the cooldown elapses. The cooldown lasts 7 days.